Mastering Personal Finance: A Strategic Approach to Financial Well-Being

Personal finance is more than just managing your income — it is the strategic discipline of controlling, optimizing, and growing your resources to secure both present stability and future prosperity. It encompasses setting clear financial objectives, taking responsibility for your current financial position, and building a roadmap toward long-term success.

At the core of personal finance lies budgeting — a structured plan that allocates your income across essential expenses, lifestyle choices, savings, and investments. Regardless of your income level or payment frequency, a well-crafted budget enhances financial control, reduces stress, and accelerates the achievement of your goals.

The Strategic Framework: Budget Creation in Five Steps

- Define Your After-Tax Income

Determine your true spending power by calculating net income after taxes and mandatory deductions. Include additional revenue streams such as side businesses, adjusted for taxes and operational costs, to establish a precise financial baseline.

- Select a Budgeting Model Aligned with Your Lifestyle

Effective budgeting is not “one-size-fits-all.” Choose a system that aligns with your spending patterns, objectives, and personality. A proven approach is the 50/30/20 rule, strategically allocating:

- 50% to essential need: housing, utilities, transportation, insurance, minimum debt obligations, and work-related expenses.

- 30% to lifestyle wants: dining, leisure, travel, and discretionary spending.

- 20% to wealth-building: savings, investments, and accelerated debt repayment.

- Optimize Necessities

If essential expenses exceed 50% of your income, temporarily adjust allocations while exploring cost-reduction strategies such as refinancing loans, negotiating insurance premiums, or switching to more competitive service providers.

- Balance Lifestyle and Financial Discipline

Wants should enhance life quality without undermining your financial objectives. Incorporate leisure spending strategically to maintain budget adherence while prioritizing debt reduction and savings.

- Commit to Savings and Debt Reduction

Dedicate a minimum of 20% to future security — building emergency reserves, funding retirement, and eliminating high-interest debt. Align these allocations with your long-term goals to ensure sustained growth and resilience.

Beyond the 50/30/20 Rule

Flexibility is key. Alternatives such as the 60/20/20 model may better suit individuals with higher fixed costs. The best budget is one you can maintain consistently, supported by tools you will actively use — from traditional ledgers to advanced digital apps.

At Daniel Solutions, we transform budgeting from a basic task into a powerful financial strategy. Through personalized guidance, data-driven analysis, and proven methodologies, we empower individuals and families to achieve lasting financial independence while enjoying the lifestyle they desire.

Why Choose Daniel Solutions?

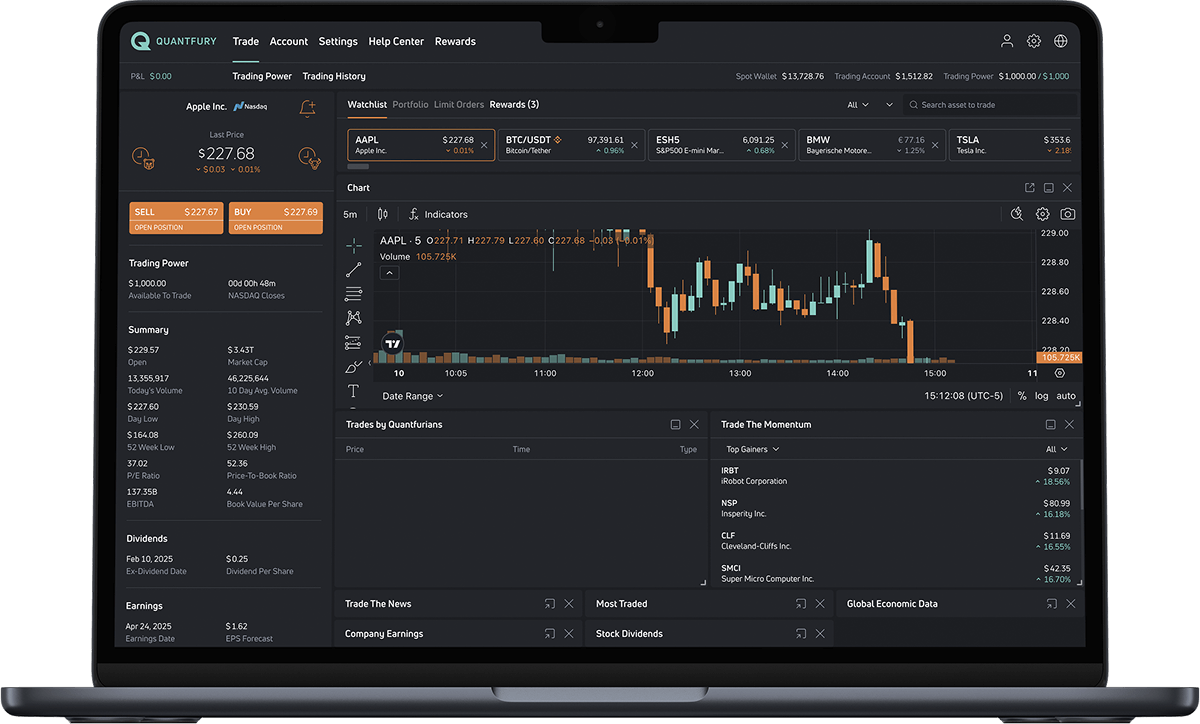

We combine cutting-edge technology with market expertise to empower traders at every level. Whether you are scalping the Forex market, investing in global equities, or exploring crypto, Daniel Solutions equips you with the tools, education, and support needed for success.

✔ Regulated & secure platform

✔ Access to over 1,000 financial instruments

✔ Dedicated support team & personal account managers

✔ Free demo account for unlimited practice

✔ Mobile & desktop platforms for full flexibility

Start Trading with Confidence

Ready to take control of your financial future?

👉 Create a free demo account and test our platform risk-free

👉 Get expert guidance and real-time analysis

👉 Access global markets 24/7 with Daniel Solutions

Your financial future starts with a plan. Let’s build it together.