Beginner’s Guide to Managing Your Money

From first trade to financial freedom – here’s what you need to know before going DIY.

📌 Key Takeaways

- The internet gives you tools, but not instant expertise.

- Learn Modern Portfolio Theory before allocating assets.

- Risk is more about behavior than numbers.

- Watch the market before betting real money.

- Practice with paper trading to gain experience safely.

Should You Manage Your Own Money?

Back in 1983, the first online trade—powered by what is now Daniel Solutions—changed investing forever.

Today, you have:

- Free real-time data

- Communities of traders

- Instant execution

But tools ≠ skill.

The market is the most expensive classroom in the world if you start unprepared.

The Core Knowledge You Need

1.Modern Portfolio Theory (MPT)

- Not just allocation — efficiency matters.

- Your portfolio should evolve as your life stage and risk tolerance

2.Understanding Risk

- “Risk” is often behavior-driven — investors buy high, sell low.

- Emotional discipline beats chasing hype.

3.Beating the Market?

- Efficient Market Hypothesis (EMH): prices already reflect known info.

- Picking stocks can win short-term, but consistent long-term outperformance is rare.

Training Before You Trade

• Spend time watching markets react to daily events.

• Identify volatile vs. stable assets.

• Use virtual trading accounts to learn without losing capital.

Money Rules That Work

• 50/30/20 Rule:

o 50% Needs

o 30% Wants

o 20% Savings/Investing

• Golden Rule: Spend less than you earn.

Bottom Line

Managing your own money can work—if you have the knowledge, experience, and discipline.

• For “learn money management” money → DIY is fine.

• For retirement or life savings → consider a pro until you’re battle-tested.

💡 Pro Tip:

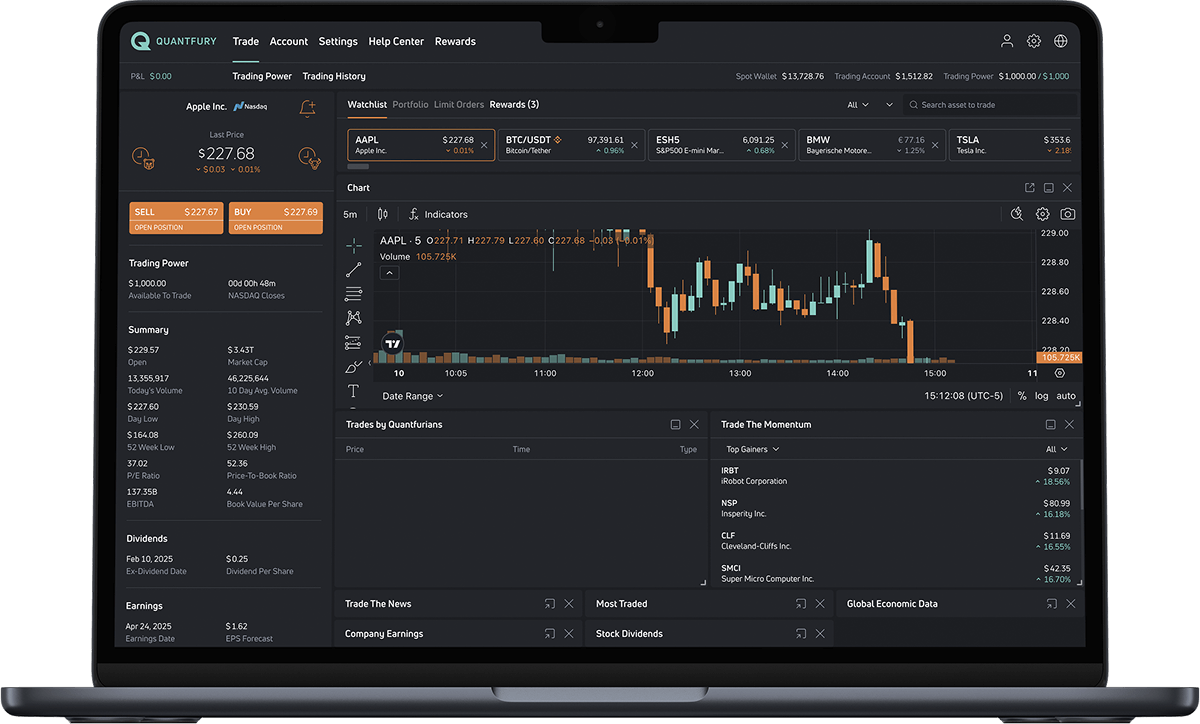

Daniel Solutions gives you market tools, portfolio tracking, and zero-fee conversions so you can trade smarter, not harder.

💥 The Daniel Solutions 50/15/5 POWER PLAN 💥

Stop bleeding money. Start building wealth.

📊 50% – Lock Down Your Core.

Half your income is your fortress: rent, food, health, transport. Keep it lean, keep it unbreakable. Cut waste like a surgeon.

💰 15% – Future-You’s War Chest.

Every paycheck, carve out fifteen percent before you even smell it. This is your retirement arsenal—feeding it is not optional.

⚡ 5% – Rapid Response Fund.

Five percent is your ammo for life’s ambushes. Breakdowns, emergencies, sudden chances—strike without debt dragging you down.

Daniel Solutions makes you bulletproof.

We turn paychecks into strategy, chaos into control, and savings into power. Stop “hoping” your finances will work out. Engineer them.

💣 Daniel Solutions | The “Money Command Protocol” 💣

Stop surviving. Start dominating.

1️⃣ Audit or Be Audited

You’re either in control of your money… or it’s in control of you. Track every cent. Slice away dead weight expenses. If it doesn’t move you toward your target, it’s gone.

2️⃣ Build the War Chest

Cash reserves aren’t “nice to have” — they’re your survival shield. Six months of expenses locked away makes you untouchable when life attacks.

3️⃣ Crush the Leaks

Restaurants, brand-chasing, impulse buys — plug every hole in the ship. If it drains your income and doesn’t make you stronger, it’s sabotage.

4️⃣ Fire Up the Income Engine

Cutting costs alone won’t make you rich. Stack income streams until your main paycheck is just the appetizer.

5️⃣ Deploy Capital Like a Weapon

Money isn’t for hoarding. It’s for conquering bigger ground — investments, assets, moves that make more money while you sleep.

Daniel Solutions turns civilians into financial operators.

We’re not here to “help you budget.” We’re here to put your money under strict orders — and make it work for you 24/7.

Income & Expense Domination Protocol

Forget “budgeting.” We weaponize your cash flow.

1️⃣ Track Every Dollar Like a Sniper

List every income source. Hunt down every expense. No ghost transactions.

2️⃣ Split Your Income Into Two Armies

• Active Income: You work for it.

• Passive Income: It works for you. (Your endgame.)

3️⃣ Classify Expenses as “Musts” or “Weaknesses”

• Mandatory: Shelter, food, survival.

• Discretionary: Wants, hype, lifestyle inflation. Cut the fat.

4️⃣ Build the Emergency War Chest

Three to six months of expenses. Untouchable. Ready for job loss, health hits, or market chaos.

5️⃣ Kill the Money Leaks

Subscriptions you forgot, luxury splurges, interest-draining debts — terminate with extreme prejudice.

6️⃣ Deploy Capital for Growth

Once survival is locked, invest.

Stocks, bonds, funds, businesses — let your money breed money.

📌 Daniel Solutions doesn’t “help you budget” — we give your money orders.

Every dollar has a mission. Zero go AWOL.