Explore the Global Financial Markets with Daniel Solutions

Understanding the Global Financial Market

The global financial market is a highly sophisticated and interconnected ecosystem that encompasses various sectors, including banking, investment management, insurance, and securities trading. It serves as a critical pillar of the global economy, facilitating the flow of capital, enabling economic growth, and supporting both private and public sector development.

This dynamic and ever-evolving industry offers a multitude of career opportunities, particularly for individuals holding a Master of Business Administration (MBA) or a Post Graduate Diploma in Management (PGDM) with a specialization in Finance. Professionals in this field are equipped to navigate complex financial systems and contribute to strategic decision-making across global markets.

Understanding the Financial Markets

Financial markets constitute a fundamental component of the capitalist economic system, serving as platforms for the allocation of capital and the creation of liquidity for both businesses and individual entrepreneurs. They function by enabling the exchange of financial assets between parties, thereby connecting those with surplus funds (investors or lenders) to those requiring capital (borrowers).

These markets generate financial instruments—such as equities, bonds, currencies, and derivatives—that offer returns to investors while channeling resources toward productive activities. Transparency of information is essential, as it underpins fair and efficient price determination.

While some financial markets operate on a relatively small scale with limited trading volume, others, such as the New York Stock Exchange (NYSE), facilitate transactions worth trillions of dollars daily. Equity markets, in particular, provide a mechanism for investors to acquire and transfer ownership in publicly listed companies. New securities are issued and sold in the primary market, while the secondary market enables the resale and exchange of existing securities among investors.

🔍 An Overview of the Global Financial Market

At its core, the global financial market consists of a vast network of institutions, investors, corporations, and governments, all engaged in the allocation of capital and financial risk. These include:

- Commercial and investment banks

- Insurance and reinsurance companies

- Stock and bond markets and

- Asset management firms and hedge funds

At its core, the global financial market consists of a vast network of institutions, investors, corporations, and governments, all engaged in the allocation of capital and financial risk. These include:

At its core, the global financial market consists of a vast network of institutions, investors, corporations, and governments, all engaged in the allocation of capital and financial risk. These include:

🚀 Innovation and Transformation

In recent years, the global financial market has experienced transformative changes driven by technological innovation. The rise of financial technology (FinTech) has disrupted traditional financial services and introduced cutting-edge solutions such as:

- Mobile banking and payments

- Algorithmic and high-frequency trading

- Cryptocurrencies and block chain applications

- Robo-advisors and AI-driven portfolio management

- Decentralized finance (DeFi)

These innovations are reshaping the way financial services are delivered, improving efficiency, enhancing transparency, and expanding access to global markets.

At Daniel Solutions, we believe that informed traders make better decisions. Financial markets are now at your fingertips — offering endless possibilities for growth, diversification, and opportunity. Whether you’re starting your trading journey or expanding your portfolio, Daniel Solutions gives you access to the world’s most powerful trading environments from one secure platform.

1. Forex Market (Foreign Exchange)

Foreign exchange (Forex or FX) trading involves the buying and selling of global currencies with the objective of generating profit from fluctuations in exchange rates. Despite its potential, even highly experienced and skilled traders face challenges in accurately predicting currency movements due to the market’s complexity and volatility.

The Forex (FX) market is the beating heart of global finance. With over $7 trillion in daily volume, it operates 24 hours a day, five days a week across every major financial center in the world. Forex involves speculating on the value of one currency against another, allowing traders to profit from both rising and falling prices.

At Daniel Solutions, we offer ultra-tight spreads, lightning-fast execution, and institutional-grade liquidity to make sure you never miss a market move.

Popular Pairs

Trade major, minor, and exotic pairs including EUR/USD, GBP/USD, USD/JPY, and AUD/CAD.

Our Edge

✔ 24/5 access to global markets

✔ Up to 1:500 leverage

✔ Cutting-edge trading tools and real-time news feeds

2. Stock Market (Equities)

Investing in stocks gives you a direct stake in the world’s most successful companies. Whether you believe in the future of tech giants like Apple and Microsoft or want to diversify into global blue-chip firms, the equity market is a powerful vehicle for wealth creation.

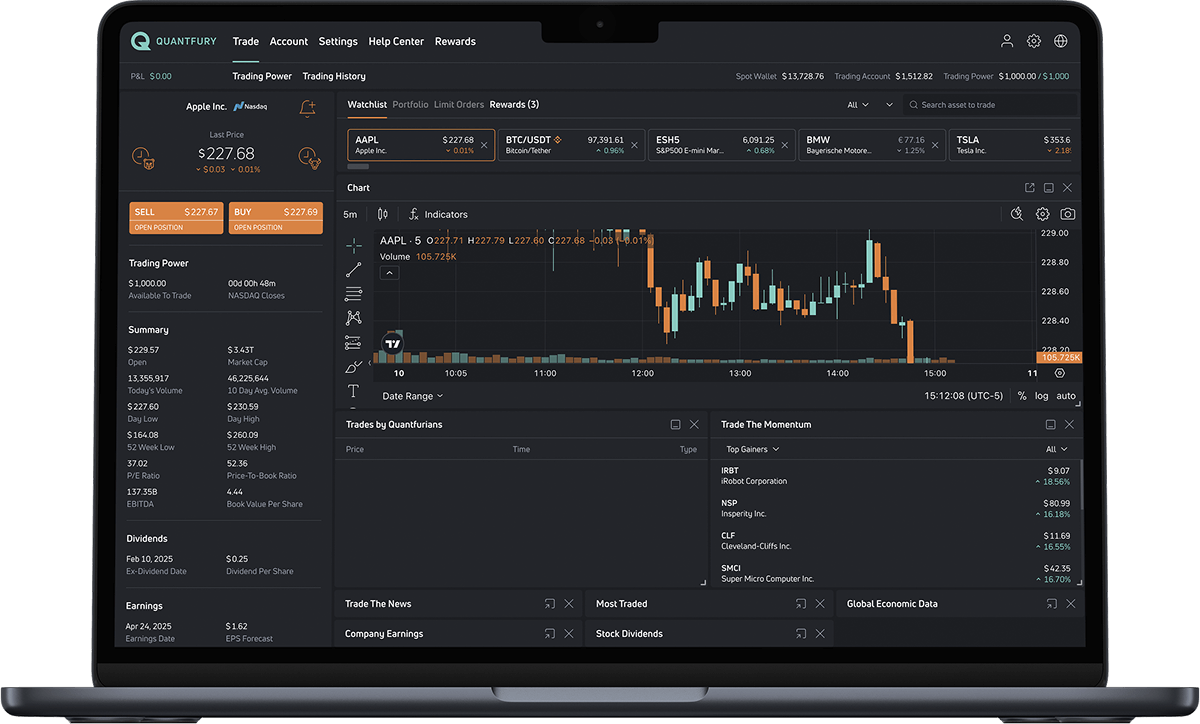

Daniel Solutions lets you trade stocks with transparency and flexibility. Access over 1,000 global equities via CFD trading or direct investment, all from one intuitive platform.

Market Access

Trade U.S., European, and Asian shares with competitive pricing and no hidden fees.

Key Benefits

✔ Real-time data & financial reports

✔ Fractional share trading available

✔ Fundamental and technical analysis tools

3. Indices (Stock Market Indexes)

Stock indices represent the overall performance of a specific market or sector. By trading indices like the S&P 500 or NASDAQ 100, you can gain exposure to entire economies with a single position.

Daniel Solutions offers low-latency index trading on global benchmarks with high liquidity and 24/5 availability.

Global Indexes

Includes US30 (Dow Jones), GER40 (DAX), UK100 (FTSE), NASDAQ, and more.

Why Trade Indices?

✔ Built-in diversification

✔ Follow macro trends

✔ Lower volatility than individual stocks

4. Cryptocurrency Market

Cryptocurrencies are revolutionizing the financial world. With assets like Bitcoin and Ethereum, digital finance is reshaping how we invest, store value, and transfer funds. Unlike traditional markets, crypto operates 24/7, creating continuous trading opportunities.

Daniel Solutions provides access to leading cryptocurrencies with advanced charting, tight spreads, and the ability to go long or short.

Top Assets

Trade BTC, ETH, XRP, ADA, and dozens of altcoins with real-time pricing.

Trading Features

✔ 24/7 availability

✔ No wallet required

✔ Built-in risk management tools

5. Commodities Market

Commodities like gold, oil, and coffee are tangible assets that play a key role in global trade. These assets often act as a hedge against inflation and political uncertainty.

Daniel Solutions gives traders access to precious metals, energies, and agricultural commodities with fast execution and global pricing.

Categories

Precious Metals (Gold, Silver), Energies (WTI, Brent Oil), Agriculture (Coffee, Wheat, Corn).

Why Trade Commodities?

✔ Hedge against inflation

✔ High volatility opportunities

✔ Excellent portfolio diversifier